SA President Anthony Burgio is calling for a re-evaluation of UB's medical insurance program, a service of Sub-Board I, because he believes students pay too much for the medical services they receive.

UB mandates that all students be covered with some form of medical insurance. Students who are covered by their parents' insurance or are insured through their employer may waive the university-proved plan by providing proof of comparable coverage and submitting a waiver by the due date of their tuition bill for the semester.

All other students, however, must enroll in the university plan.

According to Catherine Engelhardt-Ellis, director of Student Medical Insurance, the goal UB had in mandating student medical insurance was to make sure that students didn't incur medical expenses to put them at such financial risk that they wouldn't be able to continue their academic career.

While Burgio agreed that student medical insurance is necessary, he said the cost of UB's plan is too much for students to bear.

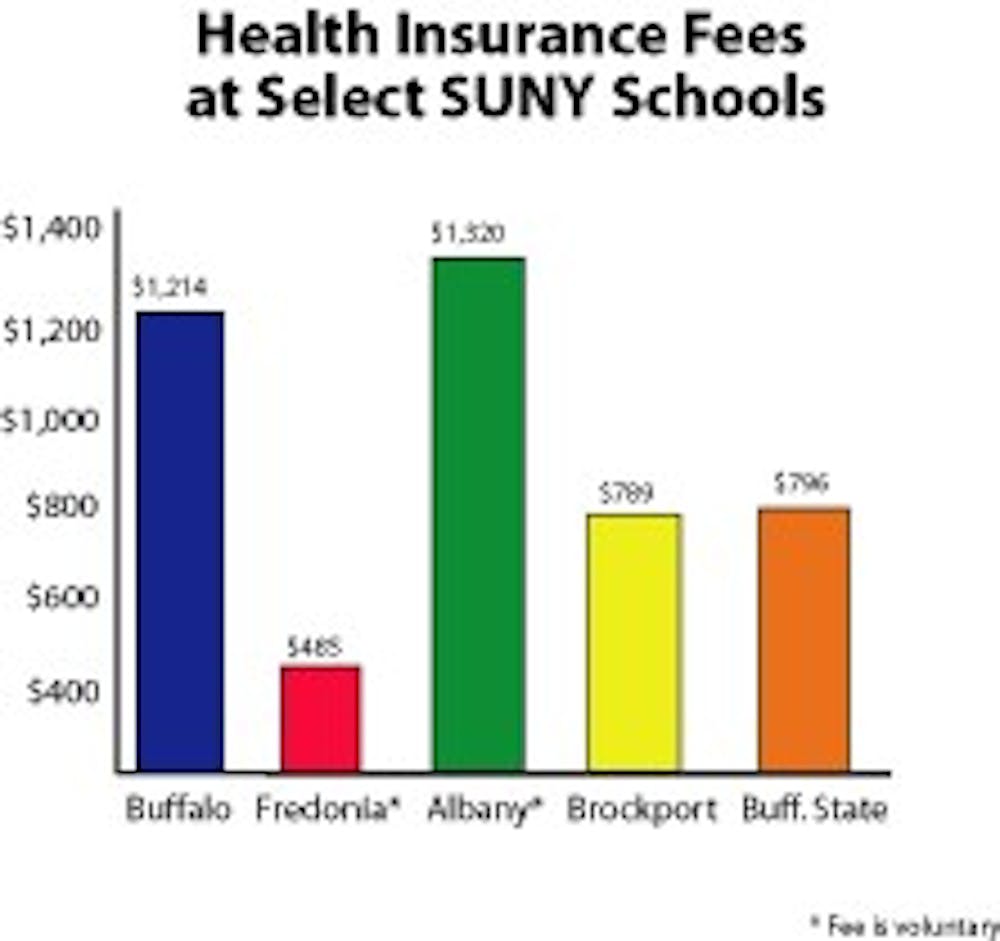

"We're paying, in some instances, twice as much as other SUNY institutions," Burgio said. "What are we getting that's better?"

The annual student premium for the UB's plan is $1,214, whereas the annual student premium for student insurance is $485 at SUNY Fredonia, $789 at SUNY Brockport, and $796 at Buffalo State. The University at Albany is the only SUNY school that charges more than UB for insurance.

Engelhardt-Ellis explained that the difference in cost is due to the fact that the premiums for these schools are being calculated with incomplete data - she said those schools won't be this cheap for very long.

"Realize that three of the other SUNY schools that have mandatory insurance policies right now have gone mandatory in the last two years. The data that insurers are using to calculate the premiums won't be complete until after three years," Engelhardt-Ellis said. "When the data is complete, they'll be able to calculate accurate premiums to charge on those plans. And if their benefits are anywhere near what we offer, they will probably have to substantially increase their premiums."

Burgio says that UB's plan offers comprehensive coverage but there should be an alternative plan offered to students, a plan with less coverage and less associated cost.

"There's definitely some value in offering cheaper services because students don't need all these extras," Burgio said. "If we could offer a reduced plan to students then that would help to alleviate some of the costs that students have to pay as it is."

Sara Ogden, a third year law student, agreed with Burgio that students should be given a choice in coverage.

"Personally, I need all the benefits, but for people who don't need all of the benefits offered by this plan it's a significant cost to bear," Ogden said. "I think it's a great idea to offer a separate plan to students who don't need as much coverage or may not be able to afford as much coverage."

Colin O'Malley, a junior international studies major, echoed Ogden's sentiments.

"I think it's important that the university offer good healthcare to its students, but it's a burden to force poorer students to buy into the university plan when they could be using the money otherwise," said O'Malley. "I'm paying for the insurance right now, but I could be using that money to pay for rent or food. UB needs to offer a cheaper alternative so that healthcare is more affordable to students who are not covered by their parents' insurance."

Engelhardt-Ellis said that even if a reduced-benefits plan were offered, there wouldn't be a significant reduction in cost.

"We could always look at it, but one of the biggest misconceptions people have about insurance is that if you pay for half the coverage you pay half the price," Engelhardt-Ellis said. "That's not how insurance companies work. Furthermore, if an alternative, or bare-bones plan was offered, the price of the comprehensive plan would rise significantly in order to absorb the extra costs associated with offering two separate plans."

The review of the university insurance plan, which is in its beginning stages, is an annual undertaking, according to Engelhardt-Ellis. Each year, Sub-Board I reviews the plan's benefits offered by its current carrier as well as the medical needs of the UB community and the costs associated with the university plan.

Every three years, there is a bid review, in which Sub-Board reviews the policy being offered by the current insurance carrier as well as policies offered by other carriers.

"We try to negotiate the best plan benefits available for the greatest good for the greatest number of students, but still within a reasonable premium," Engelhardt-Ellis said. "It's tough to do with medical costs rising, and nobody wants their premium to go up."

Some students, like Tijen Tunali, a graduate student in art history, say the coverage offered by UB's plan just doesn't cut it.

"For the amount of money that I'm paying it doesn't cover as much as it should. I get no dental coverage whatsoever," Tunali said. "For the money that I'm putting into this plan, the coverage is meager."

In the meantime, Burgio said he's pushing for a review of the benefits associated with the plan as well as the feasibility of offering an alternative.

"I'm a big skeptic of anyone who tells us we're getting the best without first looking into it," Burgio said. "At the end of the day it might turn out that it's worth it, but we should at least try to offer a cheaper alternative for students."